I have not disclosed my investment returns since a few months. This is because I started a new portfolio of trading stocks, which have a lot of churn. So I just had to understand how to keep the two portfolios separate in my database. It took me a couple of months to get around to the point of making appropriate changes in my database, and in doing the programming changes necessary.

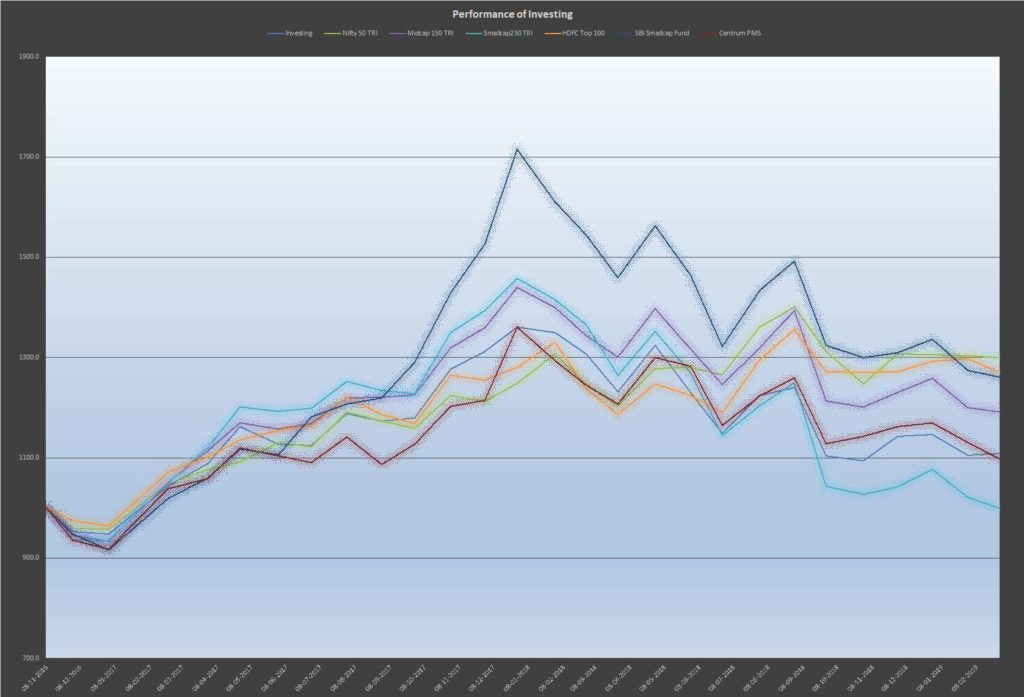

Here is a graph of in investment returns, also as compared to a number of benchmarks.

As you can see, the top performance over the last 2 years or so is no longer the SBI Smallcap fund. Riding on the basis of largecap outperformance throughout 2019 the NIFTY TRI remains the best performer of all benchmarks, followed closely by the HDFC Top 100 Fund.

Again both mutual funds, the HDFC Top 100 and the SBI Smallcap Fund, outperformed both my portfolio as well as the PMS.

Clearly performance is dictated by the kinds of stocks which constitute the portfolio, given the exceptionally large divergence in the returns of a large cap, midcap and small cap portfolio over the last year.

As I write this post, there has again been smallcap and midcap outperformance in the last month. We will see the results next month.