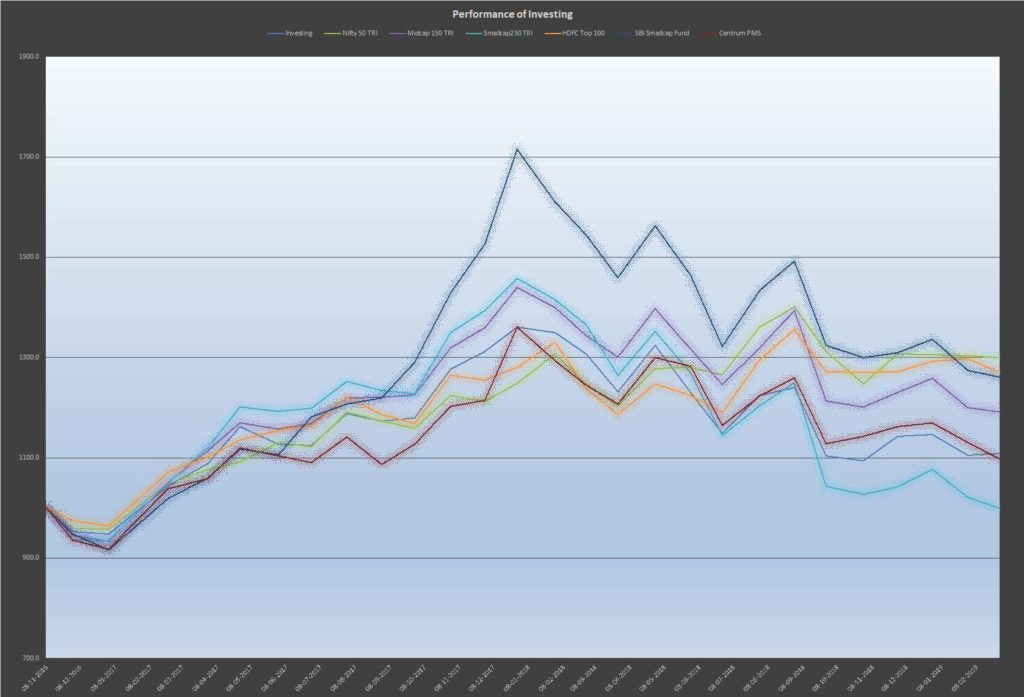

In the table, I give three figures which reflect my own performance along with other benchmarks:

Every month, I have been giving out a summary of my trading and investment performance. Here I give my own performance, along with other benchmarks. The question is, what are these benchmarks? Are they appropriate? How should one look at these benchmarks. Here I will just elaborate on these benchmarks.

a) My investment returns: This is for that capital which is deployed on a long term basis, without any leverage. The typical churn in this part of my portfolio is less than 10% a year. My investment returns as given include dividends received on stocks.

b) My trading returns: Trading returns are those returns which are given for the various trading strategies I employ. These returns in percentage terms are only on the actual capital employed (cash+cash equivalents like liquid bees). The percentage returns do not reflect the fact that approx 40% of the capital is in stocks of companies which are pledged as security. These returns must be evaluated accordingly. My trading returns also include my returns on commodity futures and interest rate futures, as well as the occasional option trade. Most such trades are always in the market (i.e., they are not long-flat, they are long-short). When the trend reverses, typically, my trade will move from long to short or vice versa.

c) My returns on traded equity: This is more recent. Since October 2018, I have deployed a significant amount of capital (Approx 15% of the total capital in my investment portfolio) into equity shares on a non-leveraged basis. The basis for selecting these stocks is purely by trend following techniques. These stocks are not meant to be invested for the long term. As soon as the trend reverses, there will be a sell. This is a long-flat strategy. No shorting is done.

Coming to the various benchmarks:

a) I have indicated the Nifty Total Return Index(TRI), Midcap-150 (TRI) and Smallcap-250 (TRI) as the appropriate benchmarks for my portfolio. My current investment portfolio consists of 20% large caps, 50% midcaps and 30% small caps. So my actual returns should be someway better than the returns of these three strategies combined in the above proportion.

b) Among other benchmarks, I have also included 2 mutual funds, both of which are famous outperformers in their respective categories. They are not the category average. These two benchmarks include the HDFC Top 100 fund (Used to be the HDFC Top 200 fund earlier), and the SBI Small Cap Fund (Used to be the SBI Magnum Small and Midcap Fund earlier).

c) I have also indicated the returns from the Centrum-920 Deep Value PMS (in which I have invested a small amount), so that my investment returns can be benchmarked with it.

d) Finally, I have indicated returns provided on a small amount of trading capital to an individual named Chandan Kumar, who trades it on my behalf, using options strategies that he has developed. My trading returns could be compared with his returns, since he uses similar amounts of leverage.